Criminals from time to time prey on SDIRA holders; encouraging them to open up accounts for the objective of creating fraudulent investments. They frequently idiot traders by telling them that In the event the investment is accepted by a self-directed IRA custodian, it need to be legit, which isn’t real. Once more, Be sure to do complete homework on all investments you decide on.

Beagle can show you each of the concealed costs which are robbing your retirement of Countless bucks.

SDIRAs will often be utilized by fingers-on investors that are prepared to take on the challenges and responsibilities of choosing and vetting their investments. Self directed IRA accounts will also be great for buyers that have specialised information in a niche market they wish to spend money on.

Simplicity of use and Technologies: A consumer-helpful platform with on-line tools to track your investments, submit files, and deal with your account is vital.

Prior to opening an SDIRA, it’s vital that you weigh the prospective advantages and disadvantages based upon your distinct economical plans and threat tolerance.

Complexity and Duty: By having an SDIRA, you've more Regulate in excess of your investments, but In addition, you bear a lot more duty.

Be in command of the way you expand your retirement portfolio by utilizing your specialized knowledge and passions to speculate in assets that in good shape with all your values. Received skills in property or personal equity? Utilize it to help your retirement planning.

Regardless of whether you’re a fiscal advisor, investment issuer, or other monetary Qualified, check out how SDIRAs can become a strong asset to increase your business and achieve your Experienced goals.

Costs for personal ETFs during the portfolios will minimize a consumer’s return and rate resource facts might be obtained in the person ETF’s prospectus.

Have the liberty to invest in Virtually any sort of asset using a threat profile that matches your investment technique; including assets which have the prospective for a higher amount of return.

Better investment alternatives implies you'll be able to diversify your portfolio past stocks, bonds, and mutual page resources and hedge your portfolio towards market place fluctuations and volatility.

An SDIRA custodian differs simply because they have the right personnel, experience, and capability to maintain custody from the alternative investments. The first step in opening a self-directed IRA is to locate a service provider that's specialised in administering accounts for alternative investments.

As you’ve uncovered an SDIRA service provider and opened your account, you may well be questioning how to truly start investing. Knowing the two The foundations that govern SDIRAs, as well as how you can fund your account, can help to lay the muse for the way forward for prosperous investing.

Subsequently, they have a tendency not to market self-directed IRAs, which provide the flexibleness to speculate in a very broader range of assets.

The tax pros are what make SDIRAs beautiful For most. An SDIRA could be each traditional or Roth - the account type you end up picking will depend mostly on your own investment and tax method. Check with all your money advisor or tax advisor should you’re unsure which is best for you.

And since some SDIRAs like self-directed classic IRAs are issue to necessary minimum amount distributions (RMDs), you’ll have to strategy ahead to make certain that you've got adequate Check Out Your URL liquidity to fulfill The foundations set by the IRS.

Bigger Charges: SDIRAs normally include larger administrative charges in comparison with other IRAs, as selected elements of the executive approach can not be automated.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Angus T. Jones Then & Now!

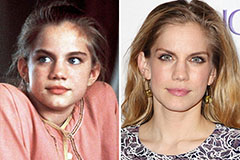

Angus T. Jones Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now!